Gifts in Wills are one of the most powerful ways to support our work and help us find new ways to prevent, detect and treat cancer for future generations.

Your gift can help us commit to long-term research projects with the biggest potential. It can also support life-saving treatments such as radiotherapy for people like Laurel, pictured above, who was diagnosed with oesophageal cancer in 2006.

Find all the information you’ll need to write your Will or update an existing one in our free guide.

Get your Gifts in Wills GuideIf you have any questions about legacy giving or need advice, your local Legacy Relationship Managers are here to support you.

Contact your Legacy Relationship Manager

Step: 1

Find all the information you need to write your Will or update an existing one.

Step: 2

Talk to our dedicated team for questions or advice. Contact your local Legacy Relationship Manager for support throughout the process.

Step: 3

Speak to a Will-writing provider to ensure your final wishes are looked after. Let us know if you’ve pledged a gift to help us plan ahead by completing this short form.

If you decide to leave a gift in your Will, there are different types to choose from.

A percentage share of your estate which can be as small or as large as you choose. This type of gift is the most valuable because it's inflation-proof. Watch our short video below to learn how percentage share gifts work.

A fixed amount of money from your estate. It can lose its value over time as costs increase.

This could be a particular item such as a car, jewellery or a property.

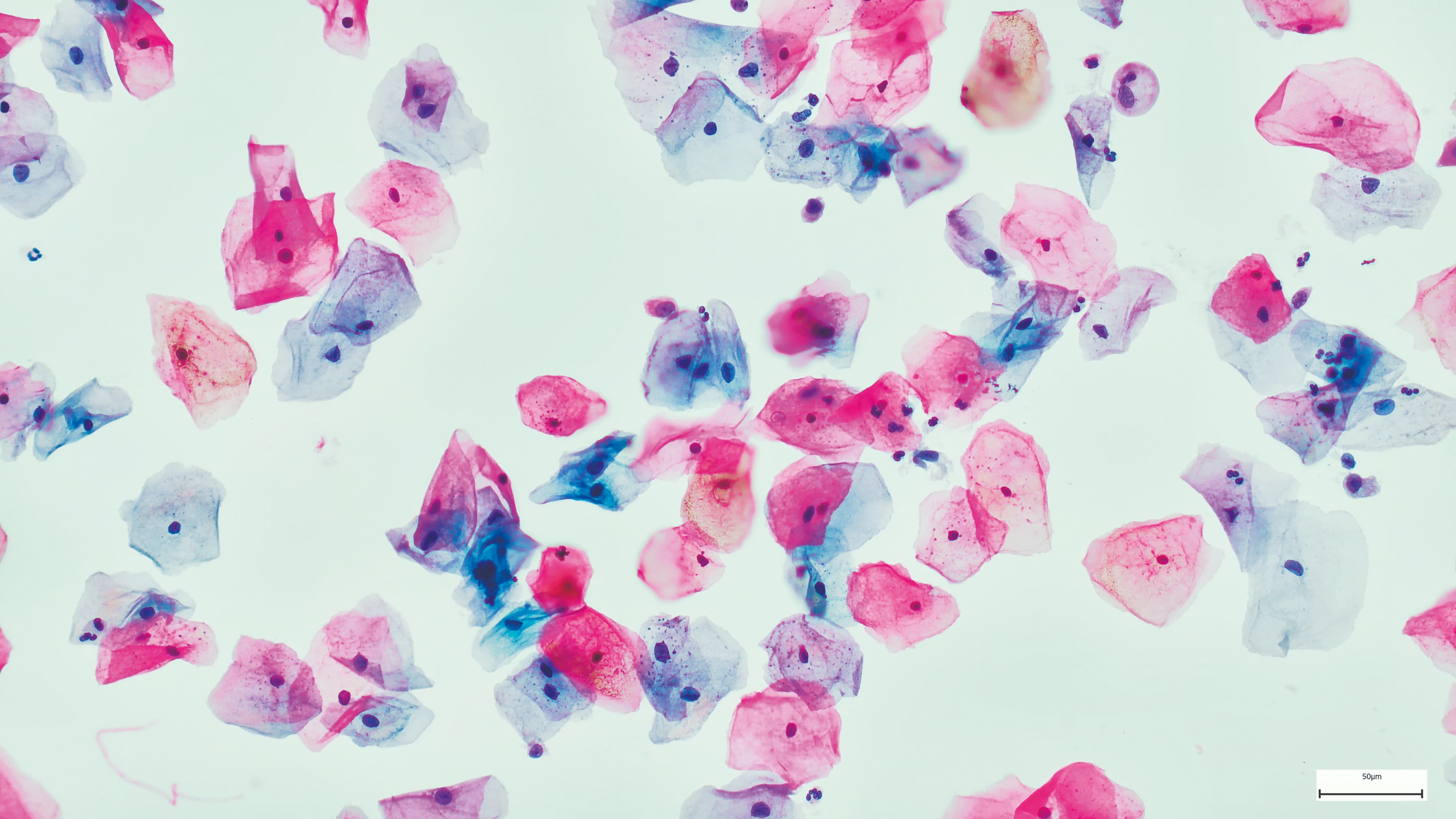

Our RadNet researchers are developing a new type of radiotherapy called FLASH that delivers high doses of radiation in fractions of a second. It’s early days, but studies show FLASH is more effective against cancer and has the potential to spare people from harmful side effects.

Our research led to the development of the HPV vaccine, which is expected to prevent almost 90% of cervical cancers in the UK. Vital protection for millions every year, made possible with support from gifts left in Wills.

Hear from our amazing researchers and discover the impact of your legacy at one of our free events.

Find answers to frequently asked questions about leaving a gift in your Will.

Write or update your Will with one of our legal experts

Get a range of support on our legal professionals' hub, from guidance on speaking and submitting forms to marketing materials.

Administering a Will can feel overwhelming, especially if you are new to the process. We have lots of resources available to support you every step of the way.